|

Insights to Financing Mechanisms Introduction D RE systems have the potential of lighting the lives of more than 1.4 billion people living off-grid worldwide. Despite increasingly innovative technologies and long-term cost effectiveness of DRE, it has not attracted much investment. This article attempts to scan financial support mechanisms worldwide which have the potential to alter the economics of this sector.One such important mechanism is the introduction of subsidies to reduce direct or indirect costs through grants to subsidise capital expenditure and provision of loans at concessional rates, either directly or as a part of a "blended finance" model. It also enhances the credit worthiness of the borrower by providing guarantee. For instance, UNEPís Rural Energy Enterprise Development (REED) seeks to lower entry barriers for RE entrepreneurs in the developing countries by providing seed capital for small-scale and innovative projects, which would be unlikely to attract commercial funding, but have potential for scalability. The Seed Capital Assistance Facility (SCAF) is a similar project operating in Asia and Africa which assists in energy-investment funds to provide seed financing for clean energy enterprises and projects. Feed-in tariff

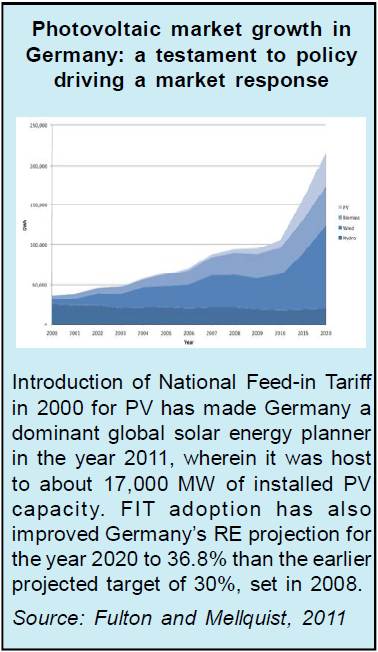

(FiT) is a favoured mechanism to boost returns of RE providers who sell

electricity in the conventional power market and receive an additional

premium as the guaranteed FiT. Following Germany and other developed

countries, FiTs are now becoming common in developing countries like

Argentina, Brazil, China, Ghana, Kenya, Malaysia, Nigeria, Pakistan and

South Africa. Moreover, mechanisms to increase the supply of appropriate finance are also being looked at. "Patient Capital Initiative" is one of the initiatives, established by Johannesburg Renewable Energy Coalition and led by Global Energy Efficiency and Renewable Energy Fund (GEEREF). GEEREF provides capital to RE funds operating in developing countries. With founding investment from the EU, Germany and Norway, GEEREF has attracted half of its target funding of US$200 million, and is particularly focused on attracting institutional investors. Green Bond is the other safe instrument which has attracted institutional and fixed-income investors for long term financing as it is backed by credible institutions, which are themselves backed by sovereign states. European Investment Bank (EIB) has developed a new Green Bond Instrument, for public or private entities. Since 2007, it has issued Ä 1.4 billion worth "Climate Awareness Bonds", lending finance to projects supporting climate action in the fields of RE and energy efficiency. Following the EIBís lead, the World Bank also began issuing Green Bonds in 2008. Since then, US$ 2 billion have been raised through the sale of AAA-rated bonds in 15 different currencies to fixed-income investors. Recently, International Finance Corporation has issued US$ 1 Billion AAA Green Bond to develop and promote innovative financial products that attract greater investments to climate related projects. Another potential structure is energy efficiency bonds, developed in the USA as Property Assessed Clean Energy (PACE) bonds. The instrument enables residential and commercial property owners to borrow money from municipal bodies to make energy-efficiency improvements to their properties. A recent initiative and improvement towards PACE Bonds is the Carbon PACE Bonds, which offer greater incentives to invest in clean energy and energy efficiency. Smarter finance mechanism recently introduced in the USA for renewable energy adopts well established investment structure - Master Limited Partnership (MLP) and Real Estate Investment Trust (REIT). MLPs and REITs combine fund raising advantage with tax benefits of partnership and have already proven track record for traditional energy sources. Granting the RE industry access to MLPs and REITs will provide access to low-cost capital for RE projects that conventional energy sources already enjoy. These financial support mechanisms if successfully implemented have the potential to alter the economics of the DRE sector. q Saumya Kumar References: 1. http://climatebonds.net/2013/02/ifc-usd1bn-green-bond/ 2. http://ec.europa.eu/environment/jrec/about_en.htm 3. http://geeref.com/posts/display/1 4. http://ec.europa.eu/environment/jrec/about_en.htm 5. http://treasury.worldbank.org/cmd/pdf/WorldBank_GreenBondFactsheet.pdf 6. http://www.brookings.edu/research/papers/2012/11/13-clean-energy-investment 7. http://pacenow.org 8. http://www.uneptie.org/energy/activities/reed/ 9. http://www.uneptie.org/energy/activities/scaf/ 10. Fulton, M., Mellquist, N, 2011. The German Feed-In Tariff for PV: Managing Volume success with price response. Deutsche Bank Climate Change Advisors.

|