|

Leveraging Carbon Markets

for Scaling-Up

Since

the dawn of the industrial age, human activities targeted towards

creating socio-economic development have led to severe environmental

burden, chief amongst them being the rise of greenhouse gas (GHG)

emissions in the earth’s atmosphere. This has been a cause for concern

as release of such large quantities of GHG emissions intensifies global

warming, which further exacerbates the impacts related to climate

change. Such effects are indelible, prevailing for decades, even if

anthropogenic emissions of GHG are suddenly reduced to zero. This is

detrimental to the productivity of a country’s economic activities,

which further compromises its ability to effectively mitigate/adapt to

the impacts. Particularly, it paints an alarming scenario for countries

in Africa (particularly in the Sub-Saharan region) which are amongst the

most vulnerable - primarily due to the existence of large populations of

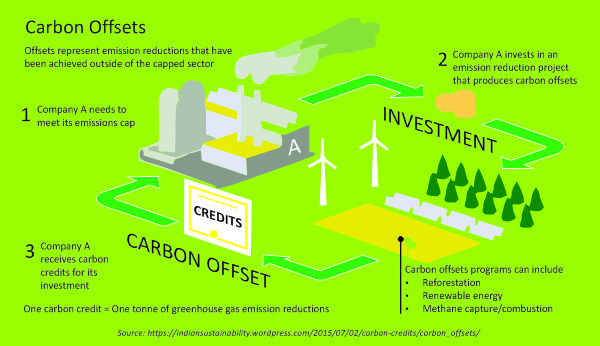

poor people dependent on the natural resource base for sustenance. Escalating threats due to climate change have prompted experts from the world over to devise an array of sweeping countermeasures; the foremost amongst them being carbon credits. A carbon credit is a tradable permit which grants the holder (or the buyer) the right to emit one tonne of carbon dioxide or equivalent greenhouse gas (tCO2e) into the atmosphere. These credits are generated by implementing mitigation projects under a GHG programme, for instance, the UNFCCC’s Clean Development Mechanism (CDM), Verified Carbon Standard (VCS) and Gold Standard (GS). Backed by real action towards climate change mitigation, resulting credits are traded in carbon markets regionally or globally. Operation of such carbon markets allows various governments to reduce their GHG emissions cost-effectively by setting limits on emissions. The figure below provides a visual representation of the working of carbon credits.

Carbon credits are not without certain draw Notwithstanding the above, carbon credits are currently the most effective financial instrument for promoting climate change mitigation and socio-economic development, particularly in the region of activity. The impacts are more far-reaching as these regions are located in the emerging and developing countries of Asia, Latin America and Africa. Africa has emerged as a new epicentre for action on compliance and voluntary carbon markets worldwide. It’s share in the global carbon markets has increased significantly going from 6% (equating to 0.56 million tonnes of CO2e) in 20071 to 15% (equating to 14.76 million tonnes of CO2e) in 20182, showcasing a CAGR of 34.64%. This has been driven by increasing focus towards creating socio-economic development in the continent coupled with the demand for carbon credits from corporate entities in Europe and North America. As a result, the credits generated in Africa enjoy the highest average selling price, ranging from USD 1-3 per tonne of CO2 mitigated. The outlook seems promising as the market is expected to continue its steady growth in the coming decade. Currently Africa is experiencing a high rate of urbanisation, occurring at 3.5%. As a result, the African construction market is projected to expand at a high CAGR of 6.4%3 over the period 2019 to 2024. This is bound to put tremendous stress on each country’s ability to supply building materials to meet the ever-rising construction needs. Moreover, growing trends in sustainable practices opens the door for low-carbon, resource-efficient building materials, which will provide an increasingly lucrative market over the next decade. Highest on the priority list should be clean, innovative technologies like the Limestone Calcined Clay Cement (LC3), Vertical Shaft Brick Kiln (VSBK) and Eco-concrete among others. Wide-scale adoption of these technologies will not only lead to huge environmental and economic benefits but will also promote social prosperity. The above prospects bring forth opportunities for implementing programmes involving incubation and transfer of clean technological solutions that generate carbon credits. This can be done by carrying out strategic, long-term interventions hinged on enterprise development, policy support and capacity building, to enable inclusive growth in various parts of Africa. Moreover, a constant revenue stream arising from generation and sale of carbon credits will enhance their operating viability. Additionally, such programmes can take advantage of the South-South Cooperation mechanism, which is more potent than the traditional bi-party engagement framework. The period for which such programmes can generate credits typically ranges from 10-21 years, which allows sufficient time for creation of substantive impacts thereby improving the existing socio-economic paradigm of the target region. ■ Endnotes:

Kranav Sharma

|

backs,

which are unavoidable. One of the most significant being the fact that

they do not represent an actual reduction of GHG by individuals or

businesses that have purchased them. Through their activities, they

continue to create emissions which are merely offset by procuring

credits generated somewhere else - resulting in a net zero carbon

footprint. Moreover, the life-cycle of carbon credits is a very long and

elaborate process, involving a lot of stages, individuals and entities

and can take up to 2 years to come to fruition.

backs,

which are unavoidable. One of the most significant being the fact that

they do not represent an actual reduction of GHG by individuals or

businesses that have purchased them. Through their activities, they

continue to create emissions which are merely offset by procuring

credits generated somewhere else - resulting in a net zero carbon

footprint. Moreover, the life-cycle of carbon credits is a very long and

elaborate process, involving a lot of stages, individuals and entities

and can take up to 2 years to come to fruition.