|

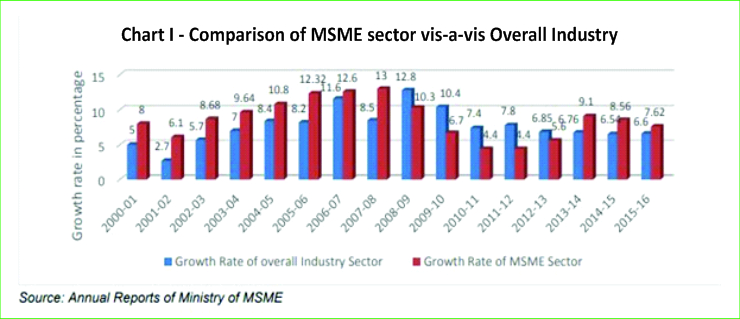

Financing Green MSMEs in India Micro, Small and Medium Enterprises’ (MSME) contribution to India’s economy and employment has been significant. India with 63 million MSMEs, accounts for about 45% of manufacturing output, more than 40% of exports and over 28% of gross domestic product. This sector employs about 111 million people. MSMEs require low capital to start business, but create huge employment opportunities. With the national scenario of resource extraction and disparate inequalities, it is imperative to focus on alternative pathways towards equitable participation and reduced economic contradictions - in order to meet our goals of sustainable development. This requires India to enable a system that appropriately localises and decentralises its production of goods and services while also integrating economic efficiency, environmental soundness, and social equity into business decisions. Environmentally conscious Micro, Small and Medium Enterprises – enterprises that build their business models on the principles of resource conservation, resource efficiency, waste management are critical enablers of green and inclusive economy at the grassroots. Anecdotal evidence suggests that for the vast majority of MSMEs, that are green in their nature and design as well as those aiming to uptake greener ways of business operations, there is a lack of data on the share of MSMEs that fall into this category and how that varies across sectors and states. Institutional Systems for Financing Green MSMEs Access to timely and adequate credit by MSMEs at a reasonable cost is essential for growth of the sector. In India, the total addressable demand for external credit is estimated to be INR 37 trillion while the overall supply of finance from formal sources is estimated to be INR 14.5 trillion. Therefore, the overall credit gap in the MSME sector is estimated to be INR 20 – 25 trillion. 5% of enterprises have access to formal finance. Access to finance tops the list with 31% of the MSMEs survey, naming it as a challenge, followed by access to markets (28%), zeroing down on the enterprise (23%) and possessing and procuring land (18%). Only 1 out of 15 micro-entrepreneurs is able to access formal credit for setting up a new enterprise. According to reports by GIZ, almost 94% of enterprises fall under the missing middle segment where credit requirement varies from Rs.50,000 to Rs.10,00,000. While MFIs support loans upto INR 50,000, banks are hesitant to support enterprises below the 10 lakh threshold.

Status Quo Analysis Despite an ongoing policy focus, growth of MSME credit has been weak. Years of mandated lending have not produced enough progress and new approaches are needed. At an overall level, India’s banking system is still small relative to the needs of the real sector. Against this backdrop, MSMEs find it challenging to access adequate credit. Access to finance remains a further continuing challenge for what could be called ‘green’ or ‘sustainable’ MSMEs – companies that seek to improve their environmental performance or are providing innovative sustainability-related products and services. The risks in turn can be traced to inability to pay and unwillingness to pay. The former can in turn be traced to business risk factors such as delayed buyer payments embedded in supply chains or supplying to government entities and also other business risks, including changes in consumer demand or extraneous events that create a slow-down in the market. MSMEs often have little or no equity buffers. Neither risk mitigation mechanisms are available to the MSMEs nor to their lenders, so this inevitably translates into significant credit losses. Even expected losses on these loans are not rationally priced. The second barrier is cost-to-serve. Assessing the creditworthiness of a MSME can be difficult due to information asymmetry, particularly with respect to financial performance of the business. In the absence of collateral, under-writing the customer often entails a “high-touch” approach which translates into higher operating cost. This can be addressed by bringing greater innovation in how small business loans are evaluated, underwritten, and managed. Electronic KYC, paperless (digital) applications, rapid loan underwriting and a greater emphasis on customer service can redefine the lending to MSME sector. The third reason is lender coverage. While many urban areas have sufficient lender coverage, there is very poor credit depth in large parts of the country. This remoteness translates into weaker access to formal credit. It is evident that a long-term strategy to increase debt to MSMEs must take into consideration the cost-to-serve and risk related issues so that it is not at odds with stability of the banking sector. It also needs to leverage upon developments such as the availability of GST data and emergence of new kinds of lenders to evolve newer methods of MSME lending.

Way forward Over the past decade, a growing number of solutions have been developed to help overcome these barriers.

Assets dedicated to investment products that intentionally seek out enterprises delivering social, environmental and financial returns are growing. These often build on traditional private equity and venture capital financing models for both growth stage companies and traditional MSMEs. ■ References

Anshul S Bhamra

|