|

Business Ecosystem for Local

Green

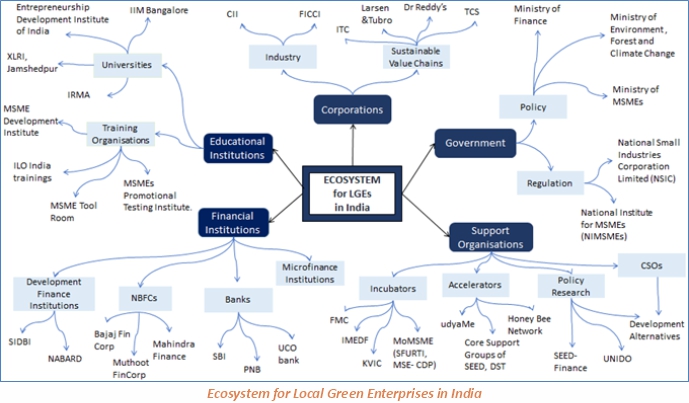

An enterprise irrespective of its size and scale is a small unit of a more complex system. In order to comprehend the challenges faced by these units, a zoomed-out approach to paint a macroeconomic portrait is the first step. The term “business ecosystem” is a network of several actors whose decisions, choices and actions affect enterprises. This becomes a graver challenge, if these enterprises are smaller in scale referring to Micro, Small and Medium Enterprises (MSMEs). There is data to support that these units comprise a huge share of private businesses across the globe accounting for greater part of the employment (Reeg et al., 2015) with the potential of being inclusive and green. This leads to creation of local jobs boosting the economy as a whole. In India alone, MSMEs showed a growth of 13.9% in net jobs created over the last four years (CII, 2019). This data indicates the pivotal role played by MSMEs in generating employment with the capability of being the key to solutions targeting integrated development including resilience building and environmental sustainability1. In other words, these have the potential to become Local Green Enterprises (LGEs) which are essentially MSMEs which build their models on principles on resource efficiency and circular economy.

In India, there are several structural

challenges that these LGEs have to face on a regular basis. To

understand these, it is necessary to map out the actors in the business

ecosystem for LGEs in India. 1. Government – The Government includes ministries and regulatory bodies. The relevant ministries identified in the LGE ecosystem in India include the Ministry of MSMEs (MoMSMEs), Ministry of Finance (MoF) and the Ministry of Environment, Forest and Climate Change (MoEFCC). The role of the Ministries would be frame and put policies in place. On the other hand, regulatory bodies are mandated to ensure that the policies put in place by the ministries are implemented in a manner that is most effective. The National Small Industries Corporation (NSIC) and the National Institute for MSMEs (NIMSMEs) are relevant regulatory bodies to name a few.

2. Corporations – Industry consists

of corporations which provide a platform for networking and building

consensus with like-minded enterprises and organisations cross cutting

across various sectors which help build an enabling environment for LGEs.

The major ones in India include Federation of Indian Chambers of

Commerce & Industry (FICCI) and Confederation of Indian Industry (CII).

There are also large corporations which have the band-width to make

their value chains sustainable. They push demand for sustainably

procured products/services top-down towards the extreme end of the

value-chain with LGEs as suppliers. A few large corporations in the

Indian market currently in the sustainable value chain space include

ITC, L&T, TCS etc. 4. Educational Institutions – These include training institutes and universities. Training institutes’ help entrepreneurs develop new skills and provide support in surviving the fast changing market. A few examples in India include MDI, ILO India and MSME Tool Room. In order to nurture the spirit of entrepreneurship, various universities in India offer courses and are also integrating it as an elective in the curriculum. IRMA, Anand and XLRI, Jamshedpur are a few universities in India that fall in this category. 5. Financial Institutions (FIs) are the most crucial actors in the ecosystem for LGEs to start, sustain and flourish.

Endnote: 1 PEP Working Group on Green Micro and Small Enterprises

Stella George

|