|

Women Federations Emerge

as a Boon for

SHG

federations have a huge potential to address poverty by serving

as a platform for providing financial and livelihood promotion services.

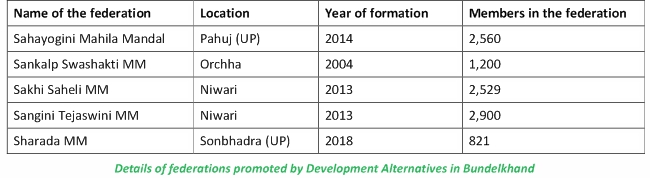

The dictionary says a federation is ‘an association o There are 5 women led federations in Bundelkhand, one of India’s poorest regions. Out of these, 3 have been actively providing micro credit services to the rural community for their livelihood purposes even during the lockdown situation. These federations have become the first choice to fulfil the financial need of the communities during this COVID-19 pandemic due to their reliability and low interest rates. These federations have taken measures to support community members in the following ways:

Yashoda from Ambabai village in Jhansi district took a loan of INR 20,000 just before the lock down. She did not suffer much of a loss in her business of beauty parlour and cosmetic store. Unlike others, she did not go to any money lenders for her financial needs and was able to manage her business from home. Narendra Kushwaha, a young entrepreneur from Ladpura village of Orchha block took the loan amount of INR 50000 just before the lock down. He used the loan amount to expand his tailoring unit into multiple business units including mobile recharge and ready-made clothes store which he runs with the support from his wife. Manish Sen from Orchha block who runs a saloon took a micro credit of INR 20,000. He used it for improving his first shop and also started a new outlet at the prime location in Orchha market area facing all the effects of lock down. He is recognised as one of the top 10 saloon service providers and this helped him to keep running his business even during the lockdown. Lessons Learnt – There is a distinct possibility of these federations promoting their own microfinance institutions in the future to serve the supplementary financial needs of the community members as they have the capacity to survive situations like lock down when financial support to the rural community becomes really tough. To meet the ever growing financial needs of the rural community irrespective of any situation, several innovations are needed, including using smart card and mobile phone technologies. A national level association to support community based microfinance is needed to advocate for the sustainability of the federation system and support rural entrepreneurship to ultimately overcome the economic crunch due to any disastrous situations in future. ■

Diksha Singh

|

f

autonomous bodies uniting for common perceived benefits’. According to

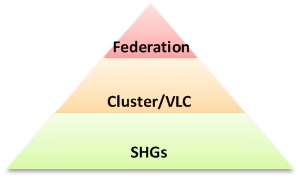

an APMAS (2005) study, “SHG federation is a democratic body formed with certain number

of SHGs functioning in a specific geographical area, with the objective

of uniting such SHGs for a common cause and for achieving these causes,

which an individual SHG would not be able to do.”

f

autonomous bodies uniting for common perceived benefits’. According to

an APMAS (2005) study, “SHG federation is a democratic body formed with certain number

of SHGs functioning in a specific geographical area, with the objective

of uniting such SHGs for a common cause and for achieving these causes,

which an individual SHG would not be able to do.”