Impacts and Benefits of Reduced GST on

Fly Ash Bricks

Overview

Fly Ash is a by-product after combustion of coal. Depending on the size fly ash is either emitted in theairor falls as bottom ash. In both the cases, fly ash is hazardous to the environment. About 70% of the totalpower generation in India is met from coal-based power plants and in 2015-16, the thermal power sector generated 176.74 million tonnes of fly ash (as Indian coal has 32.94% of average ash content). Out of this total fly ash generated,only 60. 97% was utilised (Central Electricity Authority, 2015) and the remaining 39% was dumped. Dumping of fly ash in shabbily maintained ash ponds contributes to both air and water pollution. Fly ash often pollutes surface and groundwater and the ash particles emitted in the air pose significant risks of respiratory diseases when inhaled.

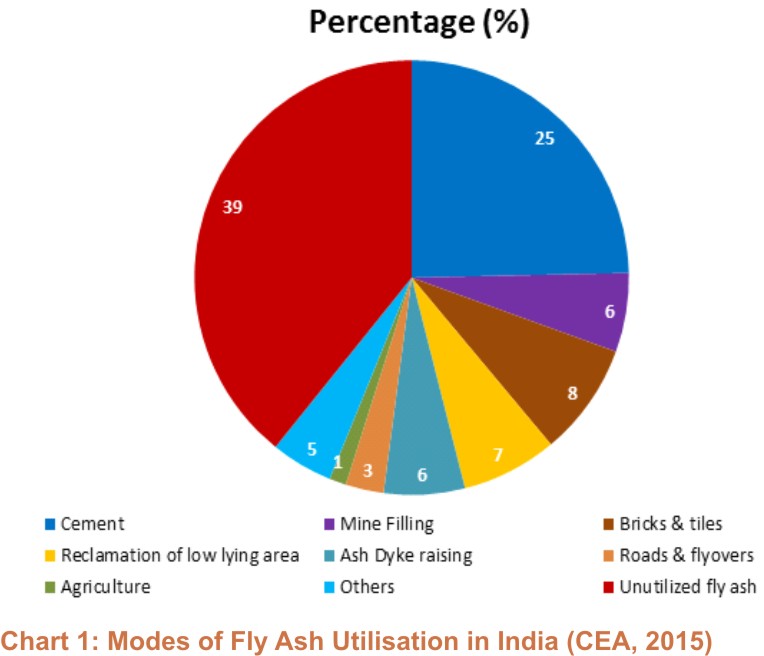

Utilising fly ash makes more sense because it converts waste and a potential pollutant into a raw material, saving other precious natural resources and energy. In India, fly ash is utilised in many modes as shown in Chart 1.

Fly Ash Bricks – Creating Wealth From Waste

India produces 200 billion bricks every year, consuming about 25 million tonnes of coal annually(Shakti Sustainable Energy Foundation & Climate Works Foundation, 2012). Conventional brick production emits CO2, SOX, NOX and other pollutants. Following are the benefits of using bricks made out of fly ash:

• It conserves fertile soil - 3 kg of soil saved per fly ash brick.

• It uses fly ash and other wastes - 1.5 kg of waste utilised per fly ash brick; 300g of fly ash used per kg of cement.

• It uses fly ash and other wastes - 1.5 kg of waste utilised per fly ash brick; 300g of fly ash used per kg of cement.

• It reduces greenhouse gas generation - 0.672 kg of carbon saved per fly ash brick.

• It conserves coal - 0.21 kg of coal saved per fly ash brick.

Note: All figures above are the author's calculation as per standard fly ash brick making recipe.

However, considering the fact that fly ash brick industry is not an alternative industry to substitute clay brick industry as it has insufficient capacity to meet the overall market demand of bricks, fly ash industry should be considered as a complementary product line in the construction and building material sector.

Reduced Goods And Service Tax (GST) on Fly Ash Bricks - Losses And Benefits

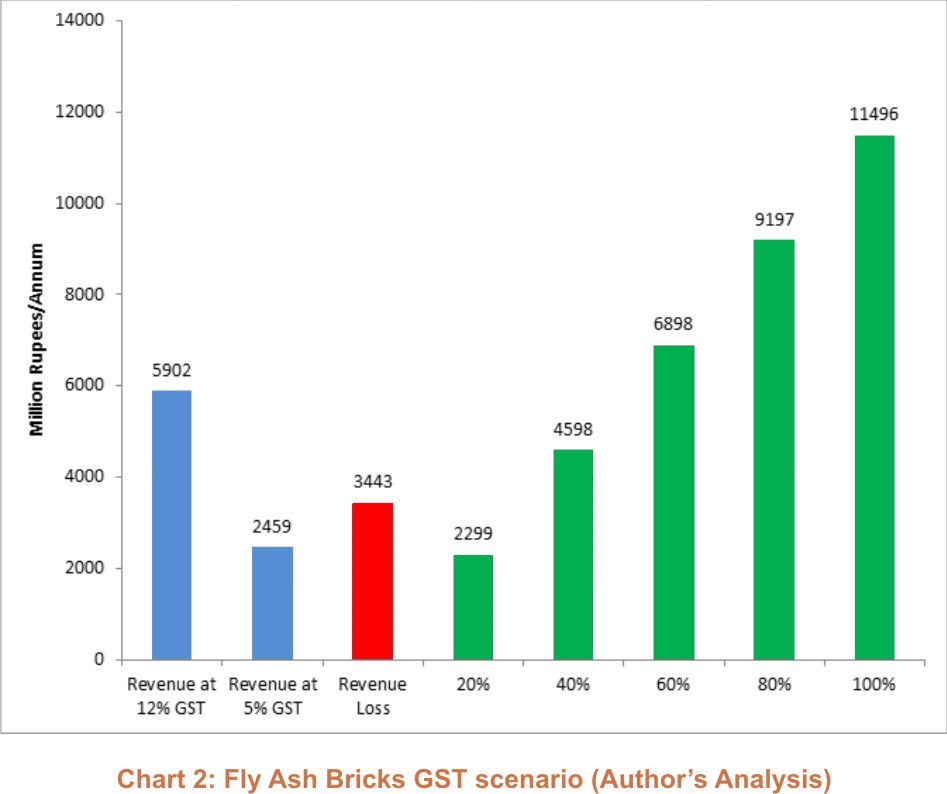

With effect from 10th November 2017, GST rates of fly ash bricks were reduced to 5% from the previous rate of 12%. The decision has ensured a level playing field for the fly ash brick manufacturers across the country as red bricks, the biggest competitor of fly ash bricks also has 5% GST rate. The decision however has also brought along revenue losses for the government. This article aims to quantify revenue losses incurred by the government due to reduction in GST rates of fly ash bricks and how these losses can be recovered by utilising the un-utilised fly ash, as mentioned in chart 1, in making fly ash bricks.

Chart 2 indicates that reducing GST on fly ash bricks will result into revenue losses of 3443 million rupees at current utilisation of 15 million tonnes of fly ash annually in bricks. However about 69 million tonnes of fly ash is lying un-utilised in the country every year. Even if 40% of this fly ash is utilised for brick production at 5% GST, the revenue losses will be covered. At 100% utilisation, the additional revenue to the country will be about 1 billion rupees. However to increase the utilisation of fly ash, it is imperative that fly ash business becomes lucrative to the entrepreneurs. Reducing the GST to 5% from current rate of 12% is an important step that GST council has taken to reap long term environmental and economic benefits from fly ash bricks.

More Benefits than Losses

More Benefits than Losses

Considering that the need for construction and building materials is continuously increasing, it makes sense to use the enormous fly ash brick making resources lying in ash ponds and polluting the environment. The national policy environment supports 100% fly ash utilisation in India. These policies should now be implemented on the ground with the aim to enhance use of un-utilised fly ash in brick manufacturing. The analysis indicates that there are short term losses but long-term revenue benefits of upscaling fly ash brick manufacturing in the country. Emphasis should be laid on creating more fly ash brick manufacturing enterprises. This will create jobs, enhance the green footprint of the construction sector and enhance utilisation of fly ash in the country. States with thermal power plants should create a policy environment which will make fly ash brick manufacturing more lucrative for investment. Creating a supply chain for free of cost fly ash delivery within 100 km of thermal power plants, preferentially procuring fly ash bricks for the government construction projects, mandatory use of fly ash bricks up to certain percentage in private construction, easy loan schemes for potential fly ash brick entrepreneurs are some of the measures that state government can take to upscale production of fly ash bricks in the state. ■

Vaibhav Rathi

vrathi@devalt.org

References:

1. Report on Fly ash generation at coal lignite based thermal power stations and it's utilisation in the country for the year 2014-15, Central Electricity Authority, New Delhi, 2015

2.Brick Kilns Performance Assessment-A Roadmap for Cleaner Brick Production in India, Shakti Sustainable Energy Foundation and Climate Works Foundation, 2012

3. http://howtoexportimport.com/ Revised-GST-rate-on-Fly-ash-bricks-8058.aspx