Delivering Access to Finance

through

Group-Based Models

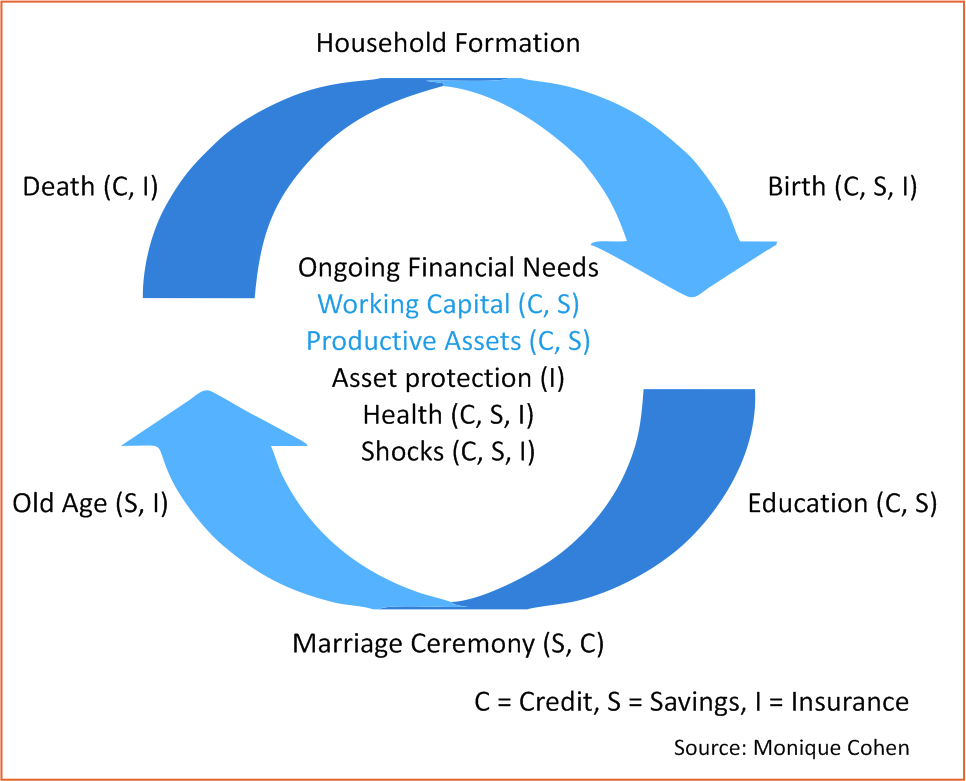

The

microfinance industry has traditionally seen poor people’s need s for

financial services simply as “credit for enterprise”. However, people from

economically weaker sections also need access to lump sums of money for

different life phases like for education, health or other shocks and

emergencies in their households. The diagram below outlines the diverse

needs of not just the poor, but of all of us. The most typical offerings of

microfinance institutions (working capital and productive asset loans) are

simply not adequate - and omit the other services such as savings and

insurance that might help poor households meet these needs.

s for

financial services simply as “credit for enterprise”. However, people from

economically weaker sections also need access to lump sums of money for

different life phases like for education, health or other shocks and

emergencies in their households. The diagram below outlines the diverse

needs of not just the poor, but of all of us. The most typical offerings of

microfinance institutions (working capital and productive asset loans) are

simply not adequate - and omit the other services such as savings and

insurance that might help poor households meet these needs.

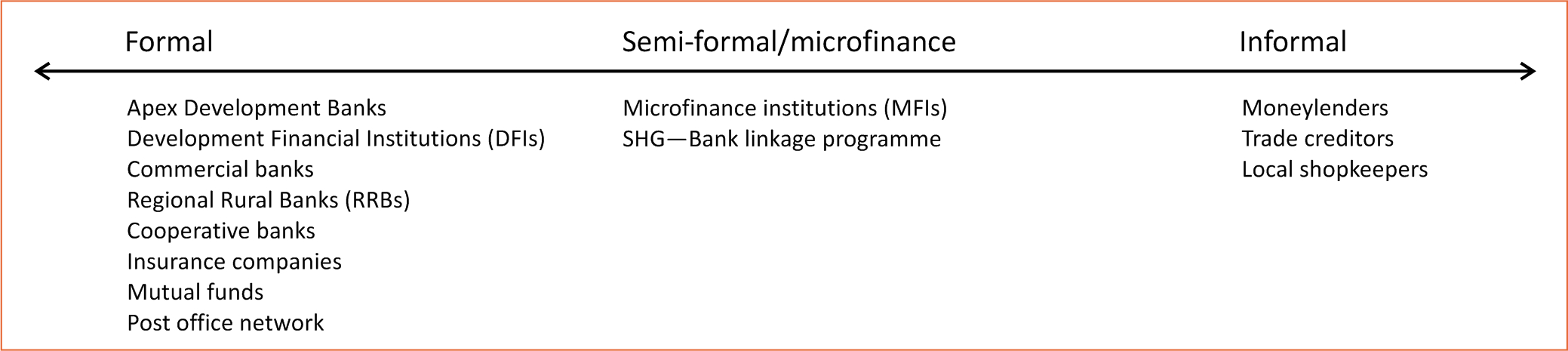

India has a range of rural financial service providers, including formal-sector financial institutions at one end of the spectrum, informal providers (mostly moneylenders) at the other end, and between these two extremes a number of semi-formal/microfinance providers.

The rural population of India faces constraints

while accessing finance formally as the financial institutions consider high

uncertainty and default risk, lack of credit information, lack of

collaterals among rural poor population, high transaction costs, weak legal

framework and enforcement issues and other issues like government policies

with high fiscal deficits as huge barriers.

To address these issues, various financial institutions have got together

and adopted various approaches like SHG-bank linkage approach: linking

commercial banks to grassroots borrowers, creation of specialised

microfinance institutions (MFIs), ‘Service Provider’ model of microfinance

piloted by private banks, innovation in micro- and weather insurances, price

insurance and risk-management products for farmers and many others.

With an aim to promote livelihood activities amongst the women of the SHGs, a micro-credit facility was started by three federations in Jhansi and Niwari districts of the Bundelkhand region. Through the micro-credit facility, which functions as a revolving fund, the federations provide micro-loans to aspiring and existing entrepreneurs. Loans are sanctioned based on applications for technically feasible and financially viable enterprises. The finance obtained must enhance the production, productivity, and profitability of the enterprises. Apart from credit lending, federations also provide support in the form of capacity building for the community and help in market linkages wherever possible.

The micro-credit facility offered by the federations disburses micro loans ranging from INR 10,000 to INR 50,000 at 1% interest rate (per month) for a maximum of 12 months. A total of 101 enterprises (of the members) have been linked to the micro credit facility and INR 23.57 lakhs loaned in a duration of 18 months during the pilot phase for enterprises like vermicomposting, information centres, e-rickshaws and construction materials. The repayment rate of the micro credit facility is close to 98%.

There are multiple challenges that such models have to face, as they do not provide a standard service to everyone, as it has to be tailored as per the need of the person accessing finance. But as more organisations innovate and implement such models, the dream of inclusive rural finance will become a reality. ■

Ankit Mudgal

amudgal@devalt.org